#Irs amended return status how to#

Step by Step instructions on how to create a 2021 Tax Amendment Tax amendments for state tax returns can be completed from the respective state page(s). You can prepare your amendment from your account, but you will need to do this by October 15 as you will not be able to do so after this date. Amendment preparation from your account is not available for previous year tax returns. We make it easy and free for you to prepare your federal amendment for the 2021 current tax year if you have e-Filed your 2021 IRS Return on.

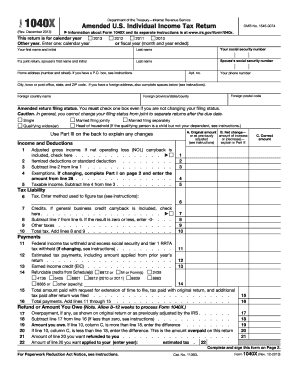

Find out about state tax amendments and previous tax year amendments. If you need to amend your federal return, you generally should amend your state return as well. If you did not use, you can use our online editor to complete the Form 1040-X below, print it, sign it, and mail it to the IRS. See how to prepare and file a 2021 IRS Tax Amendment on.

If you have prepared and eFiled a 2021 Tax Return via, you can prepare your amendment right from your account - amendments are free on. In order to make changes, corrections, or add information to an income tax return that has been filed and accepted by the IRS or state tax agency, you must file a tax amendment to correct your return(s).

An IRS tax amendment for Tax Year 2021 can be prepared on see how to amend your 2021 return here.

0 kommentar(er)

0 kommentar(er)